Google’s market power, it seems, is the economic equivalent of what in foreign affairs is called “soft power,” a term coined by the political scientist Joseph S. Nye Jr. This is the power to co-opt rather than coerce.

Since many years ago, Google has been working on increasing its market share by three basic pillars:

-

Supply side economies of scale: It is about the fact that a larger business may enjoy a cost advantage.

Google has a huge installed base on the Web (Google.com as the default search engine for Firefox and Google Chrome, Safari and Opera), mobile phones (Google Android) and desktop (Google Chrome and Chrome OS.) This huge installed base allows Google to dominate almost every application category on every platform.

Moreover, by an Internet-scale cloud infrastructure, Google also achieves economies of scale that can produce tremendous cost savings. Rather than buying off-the-shelf completed servers, they buys raw computer parts in massive quantities, and assembles custom servers with few unnecessary components. Not only does it save costs on hardware, it also minimizes overhead by consolidating on a very small number of server configurations that can be managed in bulk globally at an extremely efficient ratio of staff to machines.

On a per-user basis, these economies of scale allow Google Apps to operate at higher levels of efficiency than can be achieved by customers themselves. As far as economies of scope are considered, Google already has an established data center and it just utilizes its various applications over it. Gmail, Google Maps, Google Documents, YouTube and so on are all applications that run on the same datacenter utilizing its almost null Marginal Cost of storage.

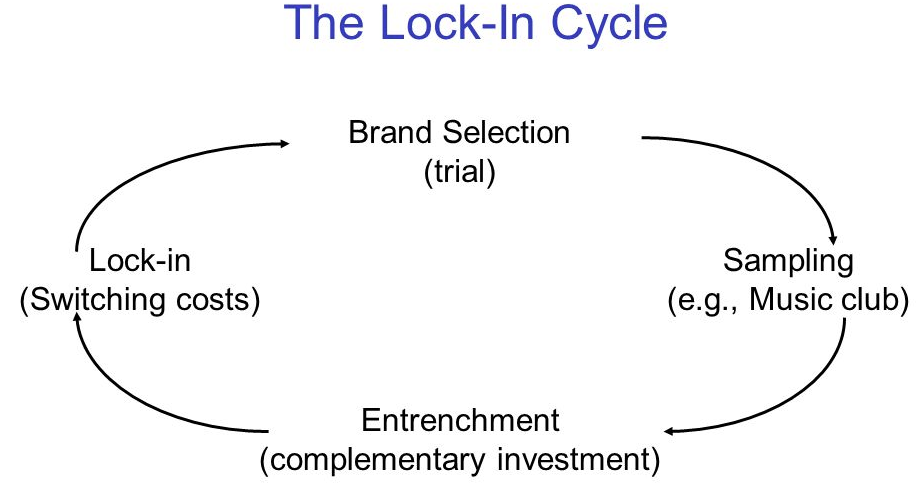

2. Lock-in: This refers to a phenomenon which makes a customer dependent on a vendor for products and services, unable to use another vendor without substantial switching costs.

If you have a look at the Google’s business strategy, you will see the search engine giant promotes lock-in and proprietary technologies:

-

Firebase and Google-dependent AMP installations as much as it advocates open PWAs.

-

They dropped XMPP in Gtalk, and Gtalk itself was deprecated, favoring Google Hangouts with a proprietary protocol. Let’s think about Chrome Web Store, which is a walled garden like App Store.

-

They shutdown Google Reader based on RSS, an open standard. Google Cloud TPU is proprietary hardware that only exists in their datacenters, supporting their open source framework TensorFlow.

-

Google Inbox is based on non-standard, closed algorithms that promise to organize your life, an essential component of a lock-in based business model.

-

Moreover, they have just announced (08/03/2018) that they are taking what it learned from AMP and developing web standards that will allow non-AMP content to load instantly.

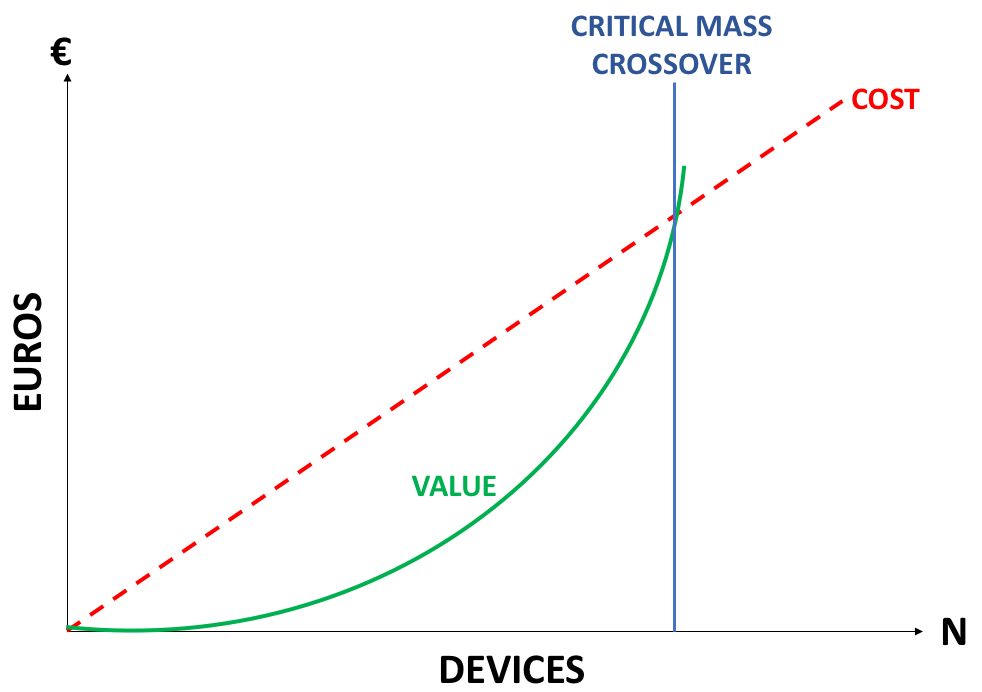

3. Network effects: Essentially, it is the effect described in economics and business that one user of a good or service has on the value of that product to others. When a network effect is present, the value of a product or service is dependent on the number of others using it.

There is nothing new about the concept. It was true of railways, telephones and fax machines, for example.

But the Internet has changed the rules of competition, partly because Internet software standards are more open than those in the PC industry.

Now, Google is the company prompting a rethinking the conventional wisdom about competition, business strategy and even antitrust law.

Google exploits network effects in all its products. The Google products are so much in demand that it create bandwagon effect for users to join the Google properties. When Gmail was invite only, it was so high in demand that some of the Gmail invites were auctioned on eBay by individuals.

On the other hand being a part of two sided market, Google reinforces its network effects by having more users. More advertisers come to Google network and more publishers subscribe to the Ad sense network which again brings more users and advertisers.

Bear in mind, the Google’s world market share is around 91% (StatCounter, 2017). Google’s explanation for its large share of the Internet search market is simply that it is a finely honed learning machine. Its scientists constantly improve the relevance of search results for users and the efficiency of its advertising system for advertisers and publishers.

“The source of Google’s competitive advantage is learning by doing“, said Hal R. Varian, Google’s chief economist.

In the Internet marketplace, users can easily switch to another search engine by typing in another Web address. But economists and analysts point out that Google does indeed have network advantages that present formidable obstacles to rivals. The “experience effects“, they say, of users and advertisers familiar with Google’s services make them less likely to switch. SEOs, for example, tailor web sites to get higher rankings on search engines, which drive user traffic and thus ad revenues.

Other economists highlight that the “indirect network effects” are very powerful for Google: they include large numbers of users, the ability to learn from those users, the power of a well-known brand and user inertia.