Enjoy dynamic listening on the go—this podcast, AI-generated for your convenience, is perfect for driving, commuting, or waiting in line!

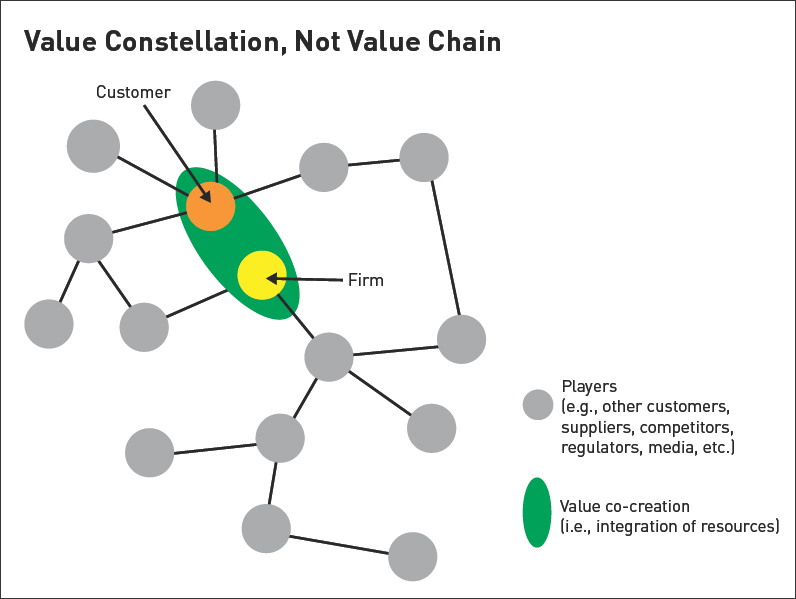

As long as 20 years ago the image of a constellation was being employed to describe value captured from a network of multiple points and not necessarily along a sequenced or linear “value chain.” It was in the digital market, explicitly built on webs of interaction, that the idea of value constellations took hold in business-model design.

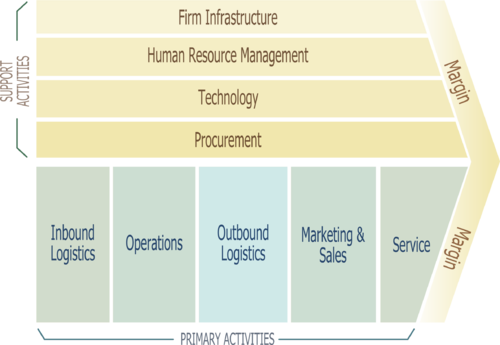

This model was the “natural” evolution of the Michael Porter’s Value Chain. Porter’s model as both a concept and tool has been used for the last 30 years to understand and analyze industries. It has proved a very useful mechanism for portraying the chained linkage of activities that exist in the physical world within traditional industries, particularly manufacturing. However, as products and services become dematerialized and the value chain itself no longer having a physical dimension, the value chain concept becomes in an inappropriate device with which to analyze many industries today and uncover sources of value. This is particularly evident in sectors such as banking, insurance, telecommunications, news, entertainment, music and advertising.

The value constellation’s persuasive power is in its expansive view of an idea’s potential. Value constellations take a commercial idea beyond the binary buyer-seller value chain to more complex, symbiotic transactional webs among multiple participants, each of which may create and consume value. In these webs, the sources of value go beyond direct monetary exchange. The best example is customer data, which in the digital age is a kind of global currency.

The competitive realities of the “digital economy” require that we rethink traditional methods for analyzing competitive environments. The old linear model do not account for the nature of alliances, competitors, complementary and other members in business networks. Traditionally, strategists use the value chain to analyze the firm and its major competitors and to identify gaps between firm performance and a implement plans to close them. This will work fine in the “physical” world.

Adopting a contrasting network approach, organizations focus not on the company or the industry, but the value-creating system itself, within which different economic actors (suppliers, partners, allies etc.) work together to co-produce value.

Value constellations are composed of complementary node and links. The crucial defining feature of networks is the complementarily between the various nodes and links. A service delivered over a network requires the use of two or more network components. Think of value networks as a set of relatively autonomous units tat can be managed independently, but operate together in a framework of common principles and service level agreements. Firm in the network are independent; otherwise they would fall into a case of almost-vertical-integration. However, the relationships enjoyed by the firms in the network are essential to their competitive positions. The structure of the constellation plays an important role in firm performance and in the industry evolution.

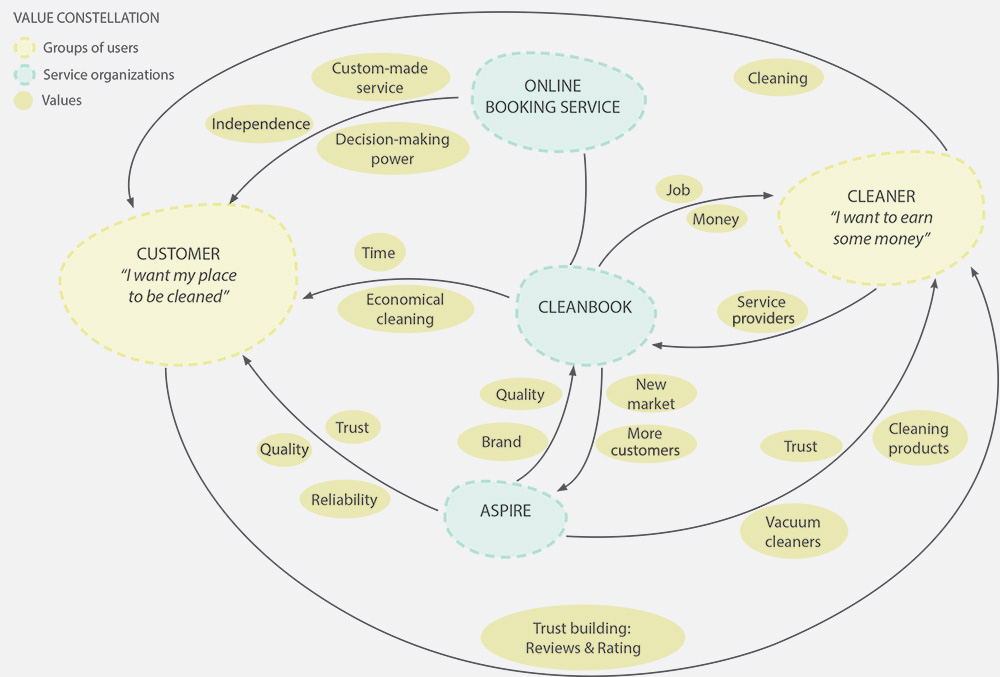

For example, let’s have a look at the Value Constellation map of a company focused on high quality vacuum cleaners:

As said, Value Constellation model is the best one to analyze and improve the digital business, in which passion and intuition are essential to the innovative personality and ultimately to market success. The popular literature of innovation insistently celebrates the gut instinct (think Jack Welch, Steve Jobs, Jeff Bezos). Stories about business giants acting on hunches are fun to relate and seem simple in the telling, almost like magic.

Basically, we can take the glimmer of an idea, a gut instinct and build a compelling business case around it to rally support just mapping its value constellation.

We need to go through some steps to map the business’ Value Constellation:

1. Define the constellation objectives. The aim is to generate a comprehensive description of where the value lies in the constellation.

2. Make a list of each player in it — who creates, buys, uses, pays for each element of the idea. It requires to identify all the actors that create and influence the value. For each, note the value being exchanged (from whom, to whom). Think beyond the conventional exchange of money (such as user interests or geographical location) and diagram these exchanges as you go.

3. Size the value constellation. Delivering value requires a clear understanding of exactly what kind of value is desired by network members. The value is as they perceive it. the objective is to capture the perceived value of the different actors in regard to being part of the extended network. It concerns implicit beliefs that guide behaviour and involves investigating why members are part of the network.

4. Define value linkages. It involves identifying the nature of linkages between the members of the Constellation. As linkages between members can take several forms, you should only consider those that feed the value dimensions identified for all actors in the step #2. More specifically, we call these linkages network influences. An influence is any linkage that impacts the perceived value dimensions and/or behaviour of a participant.

You can also refer to the Markov Chains model as scientific approach to apply the Value Constellation model into an economic environment.

In conclusion, as products and services become dematerialized, the Normann and Ramirez’s Value Constellation model becomes the best device with which to analyze many industries today and uncover sources of value. This is particularly evident in sectors such as banking, insurance, telecommunications, news, entertainment, music and advertising. In established organizations the Value Constellation makes the case for whether a profit model exists at the sales-unit level for a new idea, while from the customer perspective provides with a more rounded and positive experience.